In the Tax Paid section, you need to verify taxes paid by you in the previous year. In the Total Deductions section, you need to add and verify any deductions you wish to claim under Chapter VI-A of the Income Tax Act. In the Gross Total Income section, you need to review the pre-filled information and verify your income source details from salary / pension, house property, and other sources (such as interest income, family pension, etc.).You will also be required to enter the remaining / additional details including your exempt income, if any. You can edit your contact details, filing type details and bank details in the form.

However, you can make the necessary changes by going to your e-Filing profile. You will not be able to edit some of your personal data directly in the form. In the Personal Information section of the ITR, you need to verify the pre-filled data which is auto-filled from your e-Filing profile. Here is a quick tour of the various sections of ITR-1: ITR-1 has five sections that you need to fill before submitting it and one summary section where you are required to review your tax computation. Download the offline utility or avail a third-party software (If using offline mode).Valid mobile number linked with Aadhaar / e-Filing portal / your bank / NSDL / CDSL (for e-Verification).Pre-validate at least one bank account and nominate it for refund (recommended).

Registered user on the e-Filing portal with valid user ID and password.

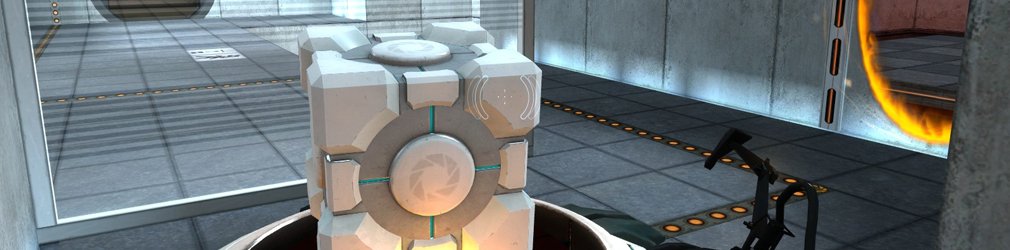

PORTAL 2 PC MANUAL MANUAL

This user manual covers filing of ITR-1 through online mode. This service enables individual taxpayers to file ITR-1 online through the e-Filing portal. The pre-filling and filing of ITR-1 service is available to registered users on the e-Filing portal.

0 kommentar(er)

0 kommentar(er)